The Financial Landscape of Gaming Acquisitions

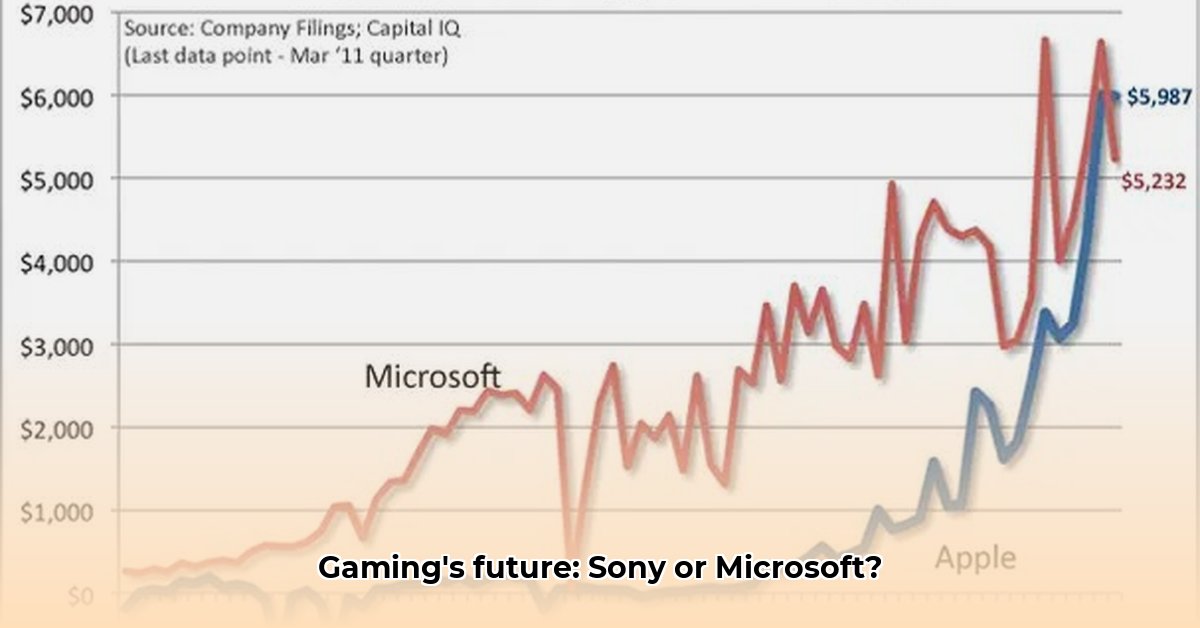

Microsoft's $67 billion acquisition of Activision Blizzard dramatically reshaped the video game industry landscape, highlighting the critical role of financial resources in shaping acquisition strategies and market dominance. This analysis explores the stark difference in net worth between Microsoft and Sony, and how this disparity influences their approaches to acquisitions, risk tolerance, and the future trajectory of the gaming sector. While precise figures fluctuate, Microsoft's net worth consistently surpasses Sony's by a significant margin – a difference that profoundly impacts their competitive strategies. This disparity isn't simply a matter of numbers; it's a fundamental driver of their contrasting approaches to market expansion and consolidation.

Acquisition Strategies: Heavyweight vs. Nimble Fighter

Microsoft's substantially larger net worth provides the financial firepower for aggressive, large-scale acquisitions. The Activision Blizzard deal exemplifies this, demonstrating their capacity to absorb significant upfront costs and navigate lengthy regulatory processes. This contrasts sharply with Sony's approach, which is likely to prioritize smaller, more targeted acquisitions or strategic partnerships due to its comparatively smaller financial resources. Microsoft's strategy can be characterized as a "consolidation" play, aiming for rapid market share expansion through high-profile acquisitions. To illustrate, a hypothetical acquisition of Epic Games would be easily within Microsoft's financial capability, while considerably straining Sony's resources. Sony's strategy, in contrast, is more focused on organic growth and maintaining its existing market share through internal development and less financially taxing collaborations.

Risk and Reward: The Calculus of Acquisition

The net worth disparity significantly influences risk tolerance. For Microsoft, the potential rewards of a high-risk, high-reward acquisition often outweigh the inherent risks due to their substantial financial buffer. A failed acquisition might represent a substantial, yet manageable setback. For Sony, however, the same acquisition might pose an unacceptable financial strain, potentially hindering future development and jeopardizing its overall market position. This difference in risk appetite leads to fundamentally different acquisition strategies. This fundamental economic reality underpins the choices and risks each company takes within the dynamic gaming market.

Regulatory Scrutiny and Antitrust Concerns

Microsoft's significant financial resources and large-scale acquisitions attract increased regulatory scrutiny. Antitrust concerns arise from the potential for undue market dominance. This leads to more thorough investigations and potential legal challenges. For instance, the FTC's lawsuit against the Activision Blizzard acquisition illustrates the intense scrutiny facing large-scale acquisitions. The regulatory hurdles facing Microsoft are significantly higher due to their market power, necessitating a more cautious approach to future acquisitions and necessitating the careful consideration of conduct remedies to address anti-competitive concerns. These regulatory landscapes present significant obstacles and require navigating complexities and potential delays.

The Future of Gaming: A Tale of Two Titans

The contrasting approaches of Microsoft and Sony, driven in part by their disparate net worths, are shaping the future of the video game industry. Microsoft's aggressive acquisition strategy aims for rapid market consolidation, potentially creating a more concentrated gaming landscape. Conversely, Sony's focus on organic growth could foster a more diverse and competitive ecosystem. The long-term consequences of these diverging strategies remain to be seen, but the current trajectory suggests a potentially significant shift in market power and competitive dynamics within the gaming industry. The ongoing competition between these two giants will undoubtedly shape the gaming landscape for years to come.

Key Takeaways:

- Microsoft's significantly larger net worth allows for aggressive, large-scale acquisitions, leading to market consolidation.

- Sony's smaller net worth necessitates a more measured approach, focusing on smaller acquisitions and organic growth.

- The net worth disparity impacts risk tolerance, with Microsoft taking on higher-risk acquisitions than Sony.

- Regulatory scrutiny intensifies with the scale of acquisitions, posing significant challenges for Microsoft.